Coal Industry Challenges in 2025: A Fight for Survival

Tulisan Populer 30 Januari 2025 Ananda Febriana Syafitri Read Time 4 minutes

Penulis: Yudhi Putro: Coal Market Analyst / Director PT Kaldera Energi Nusantara / Doctoral Student at Perbanas Institute

It is inevitable that the coal industry players must accept the fact that this industry will experience a difficult period. Various government policies, global transformation in energy policy, price fluctuations, and the narrowing growth of export and domestic markets are significant problems faced by the black gold industry.

The increase in mining costs due to the B40 policy, liquidity limitations due to the Export Proceeds (DHE) foreign exchange policy, add to the problems faced by the coal industry, not to mention the decline in demand from major importing countries, weakening coal price predictions, international political factors such as protectionist policies that can be triggered by the “Trump 2.0” phenomenon add to the uncertainty for the coal industry.

The B40 policy requires the use of a mixture of 40% biodiesel from palm oil and fossil fuels in transportation, which has a direct impact on operational costs in the mining and coal distribution sectors. The rise in biodiesel prices causes fuel costs to increase, which in turn will worsen the cost of coal logistics from the mine site to the port or consumer.

In addition, the DHE policy, which requires exporters to withhold part of their export proceeds in the form of foreign exchange, is a challenge in itself. This reduces the company’s liquidity, slows down cash flow, and increases the company’s dependence on the domestic market. Companies must adjust their financial strategies to ensure operational continuity, especially in an increasingly tight market situation and increasingly high costs.

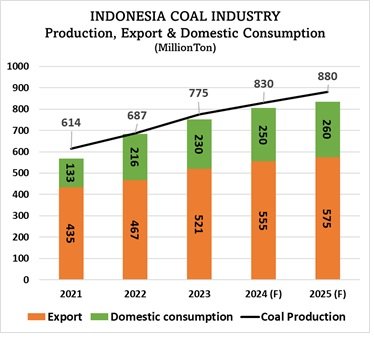

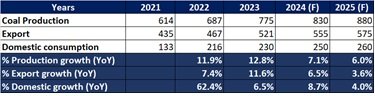

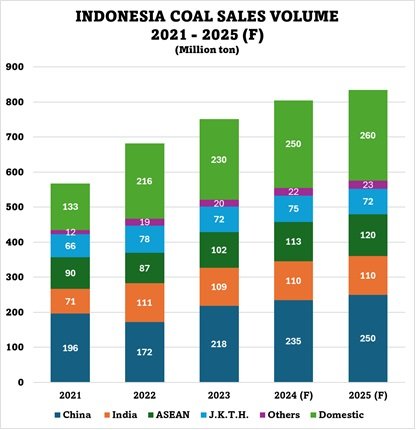

Another problem of the Indonesian coal industry is the limited growth of the export and domestic markets. Major coal importing countries, such as Japan, Korea, Taiwan, and Thailand, have experienced a decline in demand due to their energy transition policies that are increasingly moving towards renewable energy. Japan, for example, is committed to reducing its reliance on fossil fuels, while Korea and Taiwan are also switching to greener energy sources.

However, despite the decline in demand from these countries, there are still opportunities for exports to countries such as China, India, Vietnam, and the Philippines. Despite the increase in demand from these countries, the volume of exports that can be increased is still limited.

Meanwhile, the increase in domestic demand is also still there, although limited. The increase in domestic demand is expected to only range from 5 to 10 million tons by 2025. The limited growth of this increase makes the Indonesian coal industry have to face market limitations that are increasingly narrowing.

With all the above problems, coal prices in the international market also show an weak trend. While world consumption of coal is expected to stagnate and slow down as the adoption of renewable energy increases and carbon emission reduction policies become tighter in various countries, major producing countries such as Indonesia, China, and India are still increasing their production. An increase in production amid stagnant demand could lead to a supply surplus that will push prices even further, adding to the challenge for coal companies in achieving stable profits.

International geopolitical factors are also one of the major challenges for the Indonesian coal industry, especially with the potential for the Trump 2.0 policy. If the protectionist policy implemented by the United States under the previous administration is revived, this could have an impact on the global coal trade. High tariff policies and import restrictions imposed by major countries can reduce Indonesia’s coal sales in the international market.

Summary & Conclusion

To survive and thrive, coal companies need to diversify their markets, invest in more environmentally friendly technologies, and manage operational costs more efficiently. In addition, it is important to maintain financial stability and strengthen relations with domestic markets that are still showing potential, albeit limited.

Facing these challenges, Indonesia’s coal industry needs to adapt quickly and intelligently in order to survive in an increasingly changing and uncertain market.

Coal companies need to establish closer relationships with the government and other stakeholders. Through dialogue and good cooperation, companies can contribute to more favorable policies for the coal industry, such as policies that support the development of clean energy, sustainable management of natural resources, and ease of permits and regulations.

Companies must also be prepared with mitigation plans to overcome trade barriers or higher tariff policies. Adjustment of market strategies and flexible planning will help companies deal with the uncertainties arising from these external factors.

With the right and adaptive approach to change, the sector still has the opportunity to survive and thrive, even in the midst of existing uncertainties. At least temporarily. (CMA)